Checks and drafts are a few of the instruments provided by banks to their customers in order to pay for products and services. Though both checks and drafts draw from existing customer bank accounts, they also differ in several ways. There are different parties and processes involved when using checks versus drafts. Continue reading this article to understand their differences.

Summary Table

| Check | Draft |

| Parties involved are the drawer, drawee, and payee | Parties involved are the drawer and payee |

| Drawn by an account holder of a bank | Drawn by one branch of a bank to another branch of the same bank |

| Signed by the account holder before release | Does not usually have a signature as it is signed by an automated machine |

| Needs authorization from the bank and the account holder | Reliably takes out money from the account |

| Prone to fraudulent activities and counterfeiting acts | Highly protected by the bank and risks are avoided in taking out money |

| Need to be cleared and approved first | Assured and confirmed money |

| Funds can sometimes be insufficient and can bounce | Based on real credit and money in the account; once a draft is produced, the money is already used |

Definitions

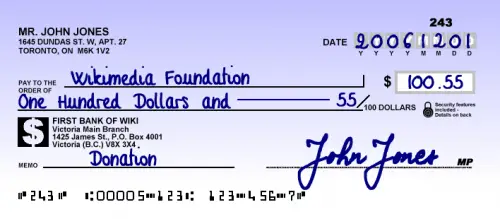

A check is a bank instrument or document that instructs a bank to pay a certain amount of money to the person or party whose name appears on the check. The money is taken from the current or checking account of the person writing the check. This person is called the drawer.

The drawer indicates the amount, date, payee, and signs the check.

Now the bank, also known as the drawee, will pay the amount stated in the check to the payee.

A check may bounce if the payer has insufficient funds in their account to cover the check.

How to Write a Check

The following information must be filled out properly for a check transaction:

- The name of the person or company; also called the payee. Be sure to include any reference number (if there is one).

- The amount of the payment in both words and numbers.

- The day’s date (month, day, year)

- Your signature

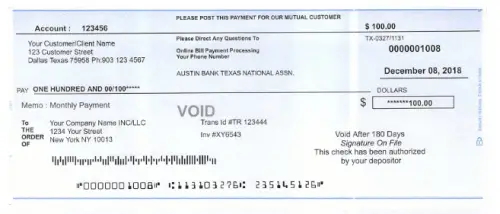

A draft is a bank instrument or document created by the bank, also known as the drawer, to be given to a payee. A bank draft is a payment that is guaranteed by a bank on behalf of a payer. Securing a bank draft requires that a payer has already deposited funds equivalent to an indicated amount plus fees to the issuing bank.

Drafts include the following features:

- Prepayment: the bank requires the payer to pay the entire amount of the draft upfront. This ensures that all the funds are available before the bank issues the draft.

- Payee specification: the draft must include the name of the payee (the person who receives the payment). Drafts are usually paid to a specific person, business, or organization.

- Secure payment: drafts are a secure payment method because the funds are paid to the bank by the payee. This means the draft will not bounce, as a check may due to insufficient funds.

- Validity: drafts usually have an expiration date. After that time, the draft may need to be revalidated and/or processed again.

In addition, while banks don’t usually charge a fee for cashing a check, they usually do charge fees for bank drafts.

Check vs Draft

The main differences between a check and a draft is in the parties involved and the methods or processes needed in the bank transactions. For checks, the parties involved are the drawer, drawee, and payee. While for drafts, only the drawer and payee are involved. Checks are drawn by a current account holder of a bank whereas drafts are drawn by one branch of a bank to another branch of the same bank.

The signature of the account holder is needed for checks.

But drafts do not usually have signatures as they are already signed by an automated machine.

Authorization from the bank and account holder is needed with checks. Also, clearing and approvals are done prior to releasing the money since checks are sometimes prone to fraudulent activities and counterfeiting acts. With drafts, you have assured and confirmed money since the amount is reliably taken out from the account. This type of bank instrument is highly protected by the bank and risks are avoided when taking out money.

There are times when funds are insufficient that is why some checks bounce. But with drafts, they are based on real credit and money in the account. When a draft is made, money is already used.

The payee may stop the check for any reason; however, a draft cannot be stopped.

A check is issued by the payer, while the bank issues the draft.

Three parties are involved in a check transaction: the drawee, the drawer, and the payee. However, only two are involved in a draft transaction: the drawer and payee.

How Long Does It Take a Draft to Clear?

While it may take several days for a check to clear, drafts may clear within 24 hours.

This is because the funds are prepaid, and there are fewer steps needed to verify the money is available to back the draft.