Planning on buying a new house or a new car? If you are, then you should know the importance of a credit score or a FICO score. These are the scores that banks or lenders refer to in order to know if you qualify for a loan.

However, if you’re not too familiar with these scores, you came to the right place.

We’ll lay down the important information about a credit score and a FICO score, as well the differences between the two.

Summary Table

| Credit score | FICO score |

| Numbers banks use to evaluate creditworthiness | Brand of credit score used by 90% of top lenders |

| Not all credit scores are FICO scores | All FICO scores are credit scores |

Definitions

A credit score is a three-digit number that indicates if a person is financially trustworthy based on that person’s credit history. This particular score is based on several factors that give banks or lenders a gauge on how likely a borrower will be able to pay the debt. High scores (740-850) make borrowers more attractive to banks and lenders while low scores (300-579) make them more of a credit risk.

A FICO score is a brand of credit score – the one that is most commonly used by banks and lenders. Back in 1989, the FICO score was created by the Fair Isaac Corporation. Since then, the FICO score has been known to be the fairest and most reliable measure of a person’s creditworthiness.

Credit Score vs FICO Score

The main difference between the credit score and the FICO score is that credit score is the general term used to describe the statistical data that measures a person’s creditworthiness, while FICO score is a brand of credit score.

Credit scores range from 300-850. A person can have more than one credit score since different companies can have different scoring models, depending on their calculations and the kind of information they have about your credit reports. Factors that determine one’s credit score are as follows: payment history (35%), amount of credit owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%.)

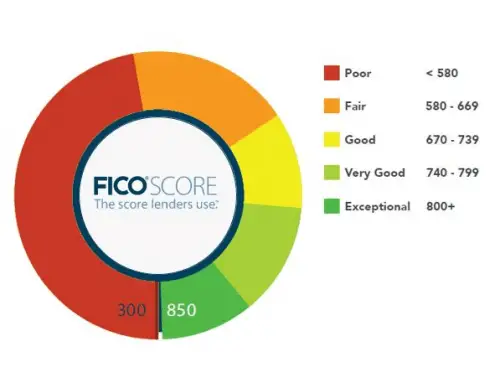

The FICO score is the most widely used scoring model. It is used by 90% of top lenders. The scores range from Poor (579 and below), Fair (580-669), Good (670-739), Very Good (740-799), and Excellent (800 and above). You would want to be in the good standing, at the very least, to easily qualify for home loans, car loans, or other types of loans.

The FICO score has been the standard for more than 25 years and is used by 90% of top lenders. Other credit score models can yield significantly different numbers compared to the FICO score. The use of FICO scores can make lending decisions fair, fast, and consistent.

It also provides a better understanding of your credit score, thus giving you more assurance when you apply for loans. Conversely, other credit score models may either under or overestimate your creditworthiness.